For anyone new to accounting, the terms “debit” and “credit” can be intimidating, confusing, and often seem counterintuitive. Why not just say increase or decrease? Why do these two Latin-rooted words dominate balance sheets, bank statements, and bookkeeping software?

The answer lies in the deep historical roots of accounting, specifically the double-entry system that dates back over 500 years. Understanding the origin and meaning of “debit” and “credit” not only clarifies their purpose but also connects us to a lineage of financial management that shaped the global economy.

The Latin Origins of “Debit” and “Credit”

The words “debit” and “credit” come from Latin. “Debere” means to owe, and “Credere” means to entrust or to believe. These terms were first formalized in accounting by Luca Pacioli, a 15th-century Italian mathematician and friar widely regarded as the Father of Accounting.

In his 1494 book Summa de Arithmetica, Geometria, Proportioni et Proportionalità, Pacioli introduced the concept of double-entry bookkeeping to a broader European audience. He used the terms “debet” (he owes) and “credit” (he trusts or has entrusted), reflecting how merchants and bankers viewed their relationships with money at the time.

Because of their Latin origins, the abbreviations for debit and credit might seem puzzling at first glance. In modern accounting, debit is abbreviated as Dr, and credit as Cr. This isn’t a typo or a random convention, it’s directly tied to the original Latin. Dr comes from “debere” (what is owed), while Cr comes from “credere” (what is entrusted). These abbreviations have been carried forward over centuries, preserving the linguistic legacy of the earliest accountants.

Debits and Credits in the Merchant’s Ledger

Imagine a merchant in 1500 Venice recording business transactions. When a customer owes money to the merchant, the merchant would record that as a debit, “debet”, because the customer is indebted to the merchant. Conversely, when someone entrusts money to the merchant, such as a deposit or investment, it is recorded as a credit, “credit”, because the merchant is now holding something that belongs to someone else.

This structure made it easier for merchants to track what they owned, what they owed, and what was owed to them. Over time, the terms “debit” and “credit” became standard vocabulary in accounting, embedded in ledgers across Europe and eventually the world.

Why the Terms Persist Today

Despite how much the world has changed since the 1400s, the fundamentals of accounting remain largely the same. Debits and credits still reflect the dual nature of every financial transaction. Every time money moves, at least two accounts are affected: one debited, one credited.

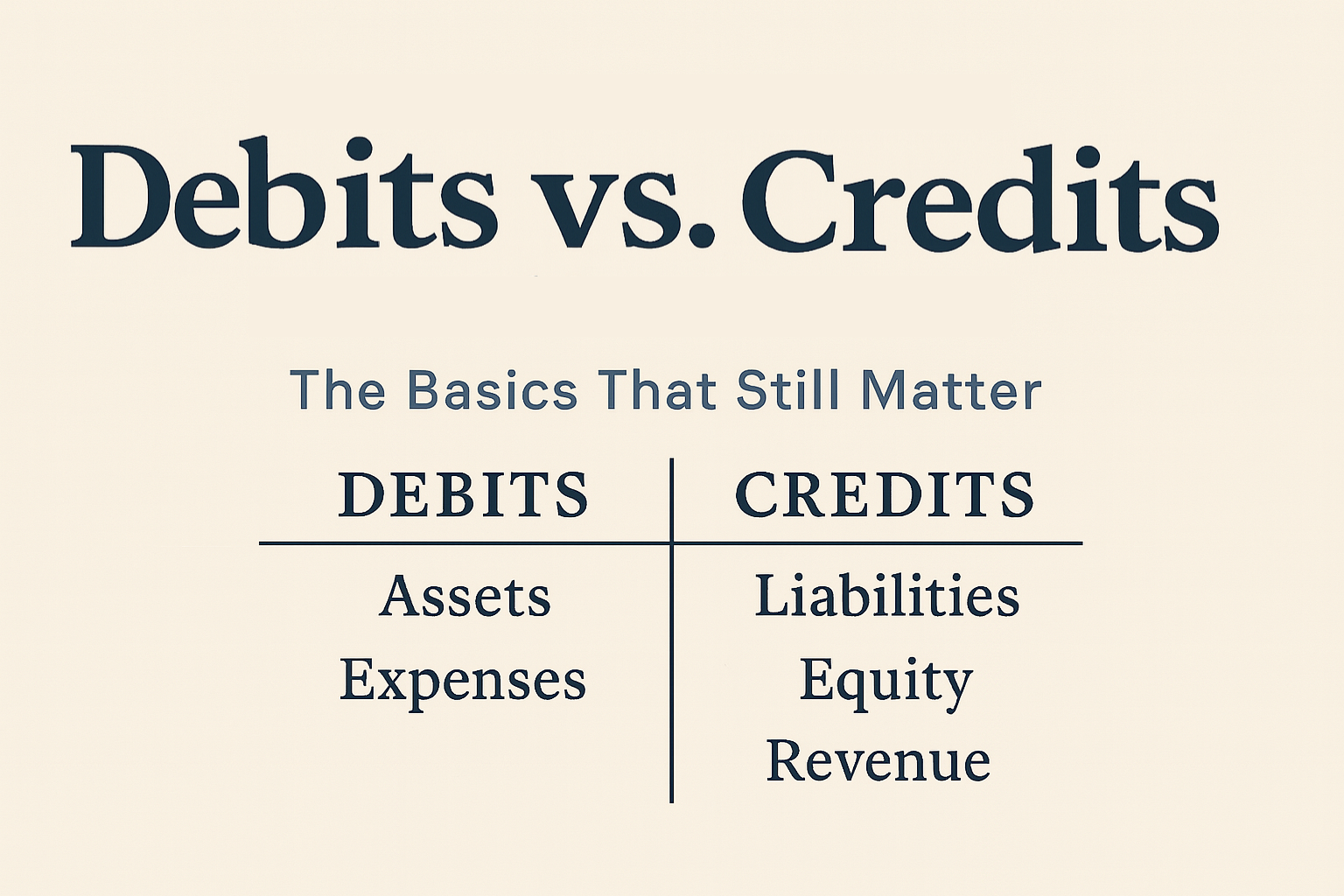

We could technically use other words like “increase” or “decrease,” but those would be ambiguous without knowing the type of account involved (asset, liability, equity, income, or expense). For example, a debit increases an asset but decreases a liability. The beauty of “debit” and “credit” is that, once you understand the framework, they give precise instructions across all account types.

And beyond clarity, there’s tradition. Accounting is a field deeply rooted in consistency and standardization. The use of “debit” and “credit”, along with their Latin abbreviations Dr and Cr, links today’s accountants to a history that spans centuries.

Modern Implications in Finance and Banking

In today’s digital age, these terms still have real impact. Whether you’re checking a bank statement, using accounting software like QuickBooks, or studying for the CPA exam, understanding why we use these words makes the entire system more intuitive.

Interestingly, as discussed in other articles, banks show deposits as credits and withdrawals as debits, because from the bank’s perspective, your account is a liability. This can confuse newcomers, but the logic holds once you realize banks are simply applying the same centuries-old accounting rules from their own viewpoint.

Overall

The words “debit” and “credit” are more than just accounting jargon, they are relics of a historical system designed for clarity, trust, and balance. Born from Latin, adopted by Renaissance merchants, and championed by Luca Pacioli, these terms have stood the test of time because they work.

Even the shorthand, Dr for debit and Cr for credit, serves as a linguistic tribute to accounting’s roots in Latin logic and merchant tradition. By understanding their origins, we gain a deeper appreciation for the structure of financial systems, and why this language of trust and obligation continues to anchor everything from your personal budget to corporate balance sheets.

Leave a Reply