Anyone who has studied basic accounting may feel a sense of confusion the first time they closely review a bank statement. After all, the rules you learn in accounting classes don’t seem to match what your bank is showing you. When you deposit money, the bank calls it a “credit.” When you withdraw money, it’s labeled a “debit.” That seems backward, doesn’t it?

Actually, this apparent contradiction isn’t a mistake at all. It’s simply a matter of perspective.

The Customer vs. the Bank: Two Different Points of View

To understand why debits and credits seem reversed in banking, you first need to realize that your bank statement is not written from your point of view, it’s from the bank’s. This is the key insight that resolves the confusion.

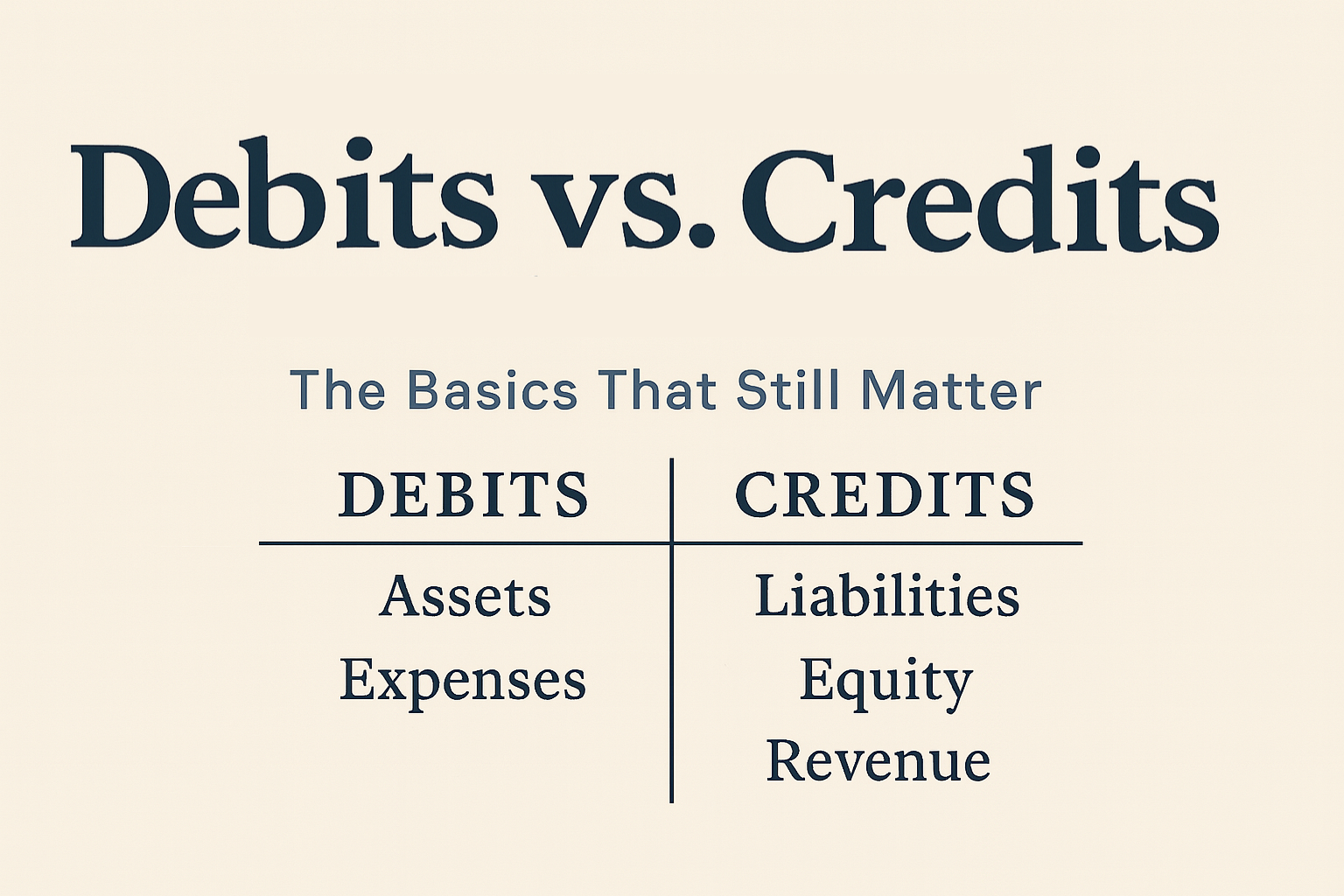

In double-entry accounting, every financial transaction affects two accounts: one is debited, and one is credited. Whether a debit or credit increases or decreases an account depends on the type of account in question: assets, liabilities, equity, revenue, or expenses.

When you, the customer, deposit money into your checking account, you are increasing an asset. From your perspective, cash on hand (or in the bank) is an asset, and assets increase with debits. So in your personal accounting records, a deposit is indeed a debit.

But from the bank’s perspective, that same transaction looks very different. Banks treat customer account balances as liabilities, not assets. When you deposit money, the bank is accepting your funds but also taking on the obligation to return them to you upon request. In other words, they owe you that money. Therefore, your account is recorded as a liability on the bank’s balance sheet.

So, when you deposit money, the bank’s liability increases, and in accounting, liabilities increase with credits. That’s why they credit your account when you make a deposit. Similarly, when you withdraw money, the bank’s liability decreases, and they reflect that decrease by debiting your account.

It’s Not Really Reversed, It’s Just Relative

This is why the terminology can be so confusing: both you and the bank are using correct accounting principles, but you’re looking at the same transaction from opposite sides. For the customer, money in the bank is an asset. For the bank, that same money represents a liability.

There’s no real reversal happening, just a shift in perspective. The bank is applying the rules of accounting from its own viewpoint, and since you’re essentially a creditor to the bank (they owe you the money), they treat your deposits as increasing their obligations.

This also helps explain why bank statements often show “credits” as positive amounts and “debits” as negative ones. For the bank, a credit to your account increases what they owe you. A debit reduces that liability. But if you were to maintain your own personal ledger, you’d be recording the opposite: debiting your cash when it increases and crediting it when it decreases.

The Importance of Understanding This Distinction

Understanding this difference in perspective is more than just an academic exercise. It’s a vital part of being financially literate. When reconciling your accounting records with your bank statement, it helps to remember that what the bank calls a credit is a debit to you, and vice versa.

This understanding is also essential for anyone studying for the CPA exam or learning double-entry bookkeeping, as it’s a common area of confusion. And for business owners, this clarity ensures you’re interpreting financial documents correctly and catching errors when they occur.

The Bottom Line

The idea that debits and credits are “reversed” in banking is a myth rooted in misunderstanding. In truth, both the bank and the customer are using the same accounting rules, they’re just on opposite sides of the transaction. Once you grasp that your deposits are liabilities from the bank’s point of view, it all starts to make sense.

So next time you see a deposit labeled as a credit, don’t be alarmed. It’s not an error, it’s accounting in action, seen through the eyes of the institution that holds your money.

Leave a Reply