Let’s be honest: when most people hear “debits and credits,” their eyes glaze over faster than you can say “double-entry accounting.” But here’s the truth: understanding debits and credits is still one of the most important foundations in accounting, no matter how much automation, AI, or fintech innovation enters the field.

In fact, the more advanced our tools become, the more essential it is to actually understand what’s going on under the hood. Whether you’re a small business owner trying to make sense of your books, a freshman student learning for the first time, or just someone who wants to stop fearing their financial software, this core concept still holds weight.

What Are Debits and Credits, Really?

At its heart, accounting is about balance. Every transaction impacts at least two accounts. That’s the essence of double-entry accounting: for every debit, there’s an equal credit. This system dates back to the 15th century but remains relevant because it’s accurate, scalable, and universal.

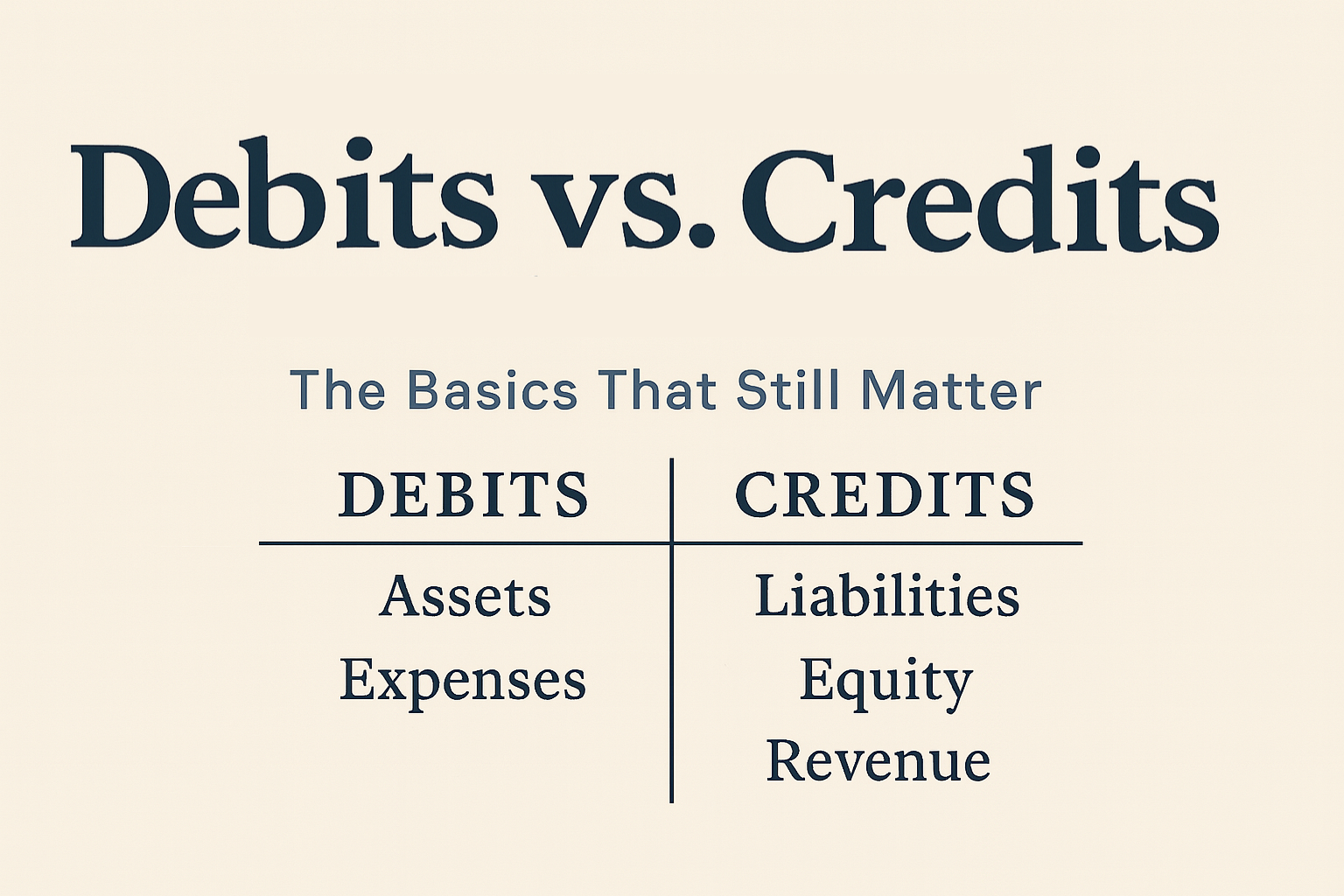

Here’s a simple way to think about it:

Debits (Dr): Typically reflect inflows of value. These increase assets or expenses.

Credits (Cr): Typically reflect outflows of value. These increase liabilities, equity, or income.

This logic holds true whether you’re buying coffee for your office or acquiring a new company. Everything gets recorded in a way that ensures your accounting equation stays balanced:

Assets = Liabilities + Equity

A Simple Table for Quick Reference:

| Type of Account | Increased by | Decreased by |

|---|---|---|

| Assets | Debit | Credit |

| Liabilities | Credit | Debit |

| Equity | Credit | Debit |

| Revenue | Credit | Debit |

| Expenses | Debit | Credit |

Real-World Examples (That Happen Every Day)

Understanding theory is great, but let’s bring this into real life with some examples that small business owners, bookkeepers, and students will all recognize:

Example 1: Paying for Rent

Transaction: You pay $1,200 for your office rent.

Debit: Rent Expense $1,200

Credit: Cash $1,200

Rent is an expense, which increases with a debit. Cash is an asset, and you’re using it up, so you credit it.

Example 2: Earning Revenue from a Client

Transaction: You receive $2,000 from a client for consulting work.

Debit: Cash $2,000

Credit: Consulting Revenue $2,000

You gain cash (an asset) and record income (which increases equity). This one’s always fun to see in the books.

Example 3: Buying Equipment on Credit

Transaction: You purchase a laptop for $1,500 on credit.

Debit: Equipment $1,500

Credit: Accounts Payable $1,500

You increase an asset, but also create a liability you need to pay later.

These examples are the bread and butter of any business. Even if you use QuickBooks or Xero and let the software do the work, you still need to understand what’s actually happening.

Why It Still Matters in 2025 (and Beyond)

You might be asking, “Can’t AI and software just handle this stuff now?” And yes, automation tools are smarter than ever. But here’s the catch: they’re only as good as the humans operating them.

If a transaction is miscategorized or posted incorrectly, even the most advanced system can’t fix a flawed input. That’s where your understanding of debits and credits comes in.

Here’s why this still matters:

Error detection: You’ll know when something looks off in your reports.

Better financial decisions: When you understand what’s driving your numbers, you can act confidently.

CPA exam prep: Debits and credits are everywhere on the exam. Don’t overlook them.

Client trust: Whether you’re an accountant or a fractional CFO, you’ll need to explain entries and reports in a way that makes sense to non-accountants.

Tech integration: When working with accounting APIs or AI tools, knowing what a balanced entry looks like is critical.

Advanced Tools, Same Fundamentals

We live in an era of machine learning, cloud accounting platforms, and automated reconciliation. But the core structure of accounting hasn’t changed. In fact, it’s even more important to understand the fundamentals today because software abstracts so much of it away.

Here’s how it applies to modern tools:

QuickBooks Online: Auto-categorizes expenses, but you still need to know if the debit/credit treatment is correct.

AI accounting assistants: Great for summarizing or classifying, but not perfect. Garbage in = garbage out.

Fintech dashboards: Beautiful charts mean nothing if the underlying transactions are wrong.

If you want to use tech to your advantage, don’t skip the basics.

Back to Basics, Move Forward with Confidence

Debits and credits aren’t just academic. They’re the DNA of accounting. When you understand them, you unlock a level of clarity that software alone can’t give you.

Whether you’re studying for the CPA, managing your own books, onboarding clients, or working as part of a finance team, this knowledge is what gives you power.

So the next time you find yourself asking, “Do I really need to know this stuff?”, remember: every financial insight, every accurate report, and every healthy business starts with a single, balanced journal entry.

Leave a Reply